How Much Does a Baby Actually Cost in 2025? The Real Numbers

Let's talk money—the stuff no one tells you about the first year with a baby

The Real Cost of Having a Baby in 2025

Let's cut to the chase: having a baby isn't cheap. But knowing what to expect can help you prepare without panicking.

According to the latest economic projections, the average cost of a baby's first year now ranges from $15,000 to $20,000. That's a big number, but remember—it varies widely depending on where you live, your lifestyle choices, and what resources you already have access to.

The good news? You don't need to have all that money upfront. Many costs are spread throughout the year, and there are plenty of ways to save without sacrificing what matters.

The Big Ticket Items: One-Time Purchases

Let's start with the stuff you'll buy once (hopefully) before baby arrives:

Nursery Essentials

- •Crib: $200-$800 (Convertible cribs cost more upfront but grow with your child)

- •Mattress: $100-$300 (This is not the place to cut corners—safety standards matter)

- •Changing table/dresser: $150-$500 (A dresser with a changing topper gives you more longevity)

- •Rocking chair/glider: $200-$700 (Your back will thank you for a good one)

- •Baby monitor: $50-$400 (Basic audio to full video with breathing monitoring)

Getting Around Gear

- •Car seat: $150-$400 (Non-negotiable and prices reflect newer safety features)

- •Stroller: $200-$1,000 (Your lifestyle matters here—city dwellers need different features than suburbanites)

- •Baby carrier/wrap: $40-$200 (Having both a structured carrier and a wrap gives you options)

Feeding Setup

- •Breast pump: $100-$500 (Call your insurance—many cover this 100%)

- •Bottles and accessories: $50-$200 (Budget for trying a few types—babies have preferences)

- •Bottle warmer/sterilizer: $30-$150 (Nice-to-have but not essential)

- •High chair: $80-$300 (You won't need this until 4-6 months)

Budget hack: Create a separate savings account specifically for baby gear. Aim to have about $1,500-$3,000 set aside for these initial purchases, depending on how much you're planning to buy new vs. secondhand.

The Monthly Stuff: Recurring Expenses That Add Up

Now for the ongoing costs that will become part of your monthly budget:

Diaper Situation

- •Disposable diapers: $80-$120 per month (Subscription services can save 15-20%)

- •Wipes: $20-$60 per month (You'll use these for everything, not just diaper changes)

- •Diaper cream: $10-$20 per month (Prevention is cheaper than treating a bad rash)

Feeding Costs

- •Formula (if not breastfeeding): $150-$250 per month (Specialized formulas cost more)

- •Breastfeeding supplies: $30-$50 per month (Nursing pads, storage bags, nipple cream)

- •Baby food (starting at 4-6 months): $60-$150 per month (Making your own cuts this cost significantly)

Clothing (They Grow So Fast)

- •Regular wardrobe updates: $50-$100 per month (They outgrow sizes every few months in the first year)

- •Seasonal items: $100-$300 per season change (Coats, swimwear, etc.)

Healthcare

- •Co-pays and medications: $30-$100 per month (Varies widely by insurance)

- •Insurance premium increases: $50-$200 per month (Adding a dependent often raises your premium)

The Childcare Question

- •Full-time daycare: $1,200-$2,800 per month (Location is the biggest factor here)

- •Nanny: $2,500-$4,000 per month (Depends on experience and hours)

- •Part-time care: $600-$1,500 per month (A popular option for families with flexible work)

Childcare is often the biggest expense for working parents. Start researching options early—many quality daycares have waiting lists.

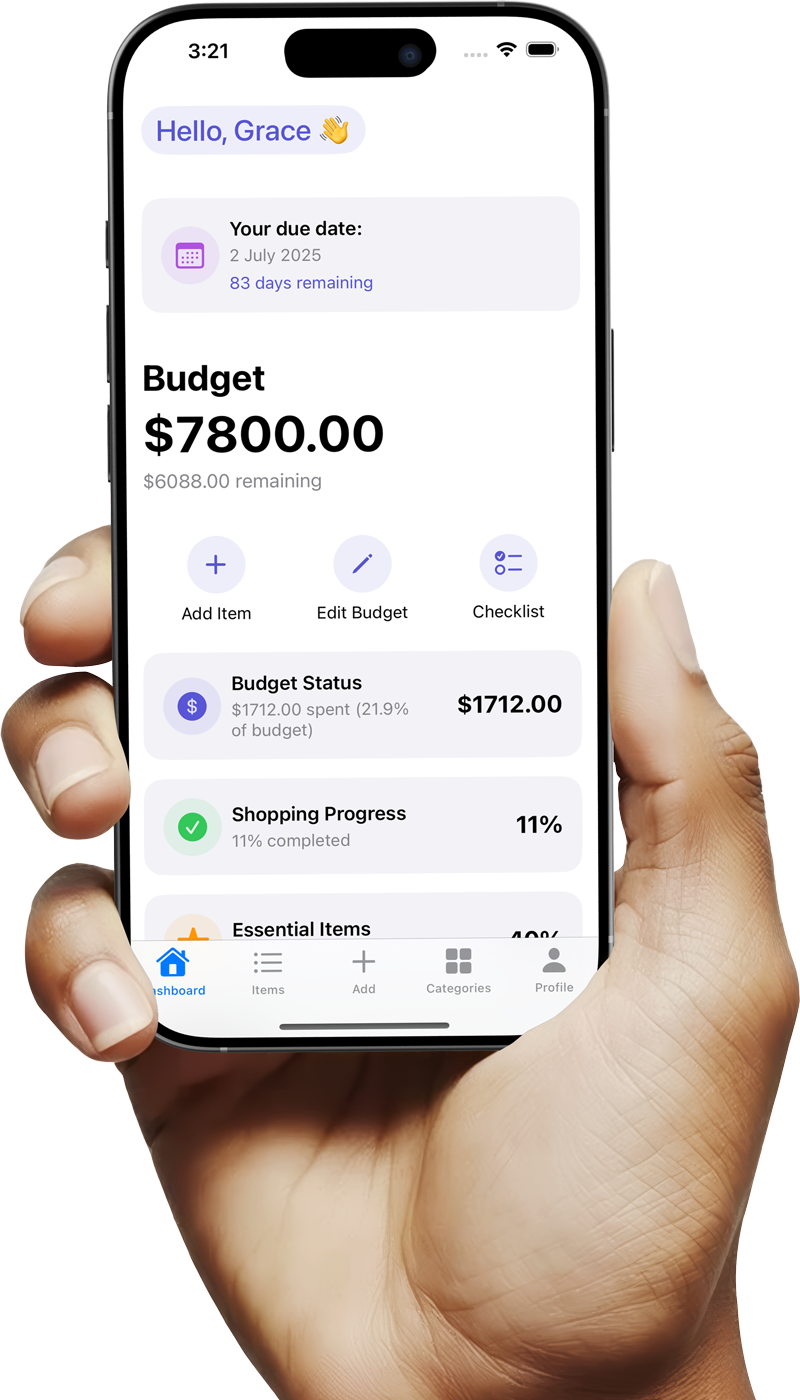

Track Your Baby Budget with Confidence

Feeling overwhelmed by all these numbers? BabyReady helps you track expenses, set category budgets, and stay on top of your finances during this exciting time.

- ✓ Track one-time and recurring baby expenses

- ✓ Set budgets for each category and get alerts

- ✓ Compare actual spending to your budget

- ✓ One-time purchase - no subscriptions

The Costs No One Tells You About

Beyond the obvious baby expenses, there are several hidden costs that can catch new parents by surprise:

Healthcare Surprises

- •Extra doctor visits: Babies get sick, and sometimes you'll want peace of mind

- •Over-the-counter medications: $20-$50 per month for basics like infant Tylenol, saline drops, etc.

- •Parent healthcare: Postpartum physical therapy, lactation consultants, mental health support

Household Changes

- •Utility increases: $30-$80 monthly (More laundry, heating/cooling, etc.)

- •Cleaning supplies: $30-$60 monthly (Babies are surprisingly messy)

- •Childproofing: $200-$500 one-time cost (Gates, cabinet locks, outlet covers)

Income Changes

- •Parental leave gaps: Many parents face unpaid leave periods

- •Reduced hours: Some parents scale back work temporarily

- •Career adjustments: Childcare logistics sometimes necessitate job changes

Money-saving tip: Consider subscription services for recurring needs. Diaper subscriptions can save 15-20% with auto-delivery, and formula subscriptions often offer 5-15% discounts. Baby clothes rental services are also growing in popularity for sustainable, budget-friendly options.

Location, Location, Location: Regional Cost Differences

Where you live dramatically impacts your baby budget:

Urban Areas (NYC, San Francisco, Seattle)

- •Average first-year cost: $25,000-$35,000

- •Main cost driver: Childcare and housing space

Suburban Regions

- •Average first-year cost: $15,000-$25,000

- •Main cost driver: Balance of services and space costs

Rural Areas

- •Average first-year cost: $10,000-$20,000

- •Main cost driver: Potentially longer travel for healthcare and lower availability of secondhand markets

Creating Your Personalized Baby Budget

Follow these steps to create a realistic budget for your situation:

- Assess your current financial situation

- •What's your monthly income after taxes?

- •What are your existing expenses and debt payments?

- •How much do you have in savings?

- Anticipate income changes

- •How long will your paid leave last?

- •Will you take unpaid leave? For how long?

- •Will your work schedule change when you return?

- Research local costs

- •What do daycares in your area actually charge?

- •What will your health insurance cover?

- •Do you have family nearby who can help?

- Create a timeline of purchases

- •What do you need before birth?

- •What can wait until 3-6 months?

- •What will you need at 6-12 months?

- Build in a buffer

- •Add 15-20% to your calculated budget for unexpected expenses

Smart Shopping Strategies for Baby Gear

You don't have to break the bank to get what you need:

- •Buy secondhand for short-term items: Babies outgrow things quickly

- •Invest in convertible gear: Cribs that become toddler beds, strollers that adapt as baby grows

- •Accept hand-me-downs: Just check safety recalls first

- •Buy new for safety items: Car seats, cribs, and mattresses should be purchased new

- •Use registry completion discounts: Many stores offer 10-15% off remaining items

- •Shop seasonal sales: Black Friday/Cyber Monday for big-ticket items

The Bottom Line: Balance is Everything

Having a baby does change your financial picture, but with some planning, it doesn't have to derail your financial health. Remember:

- •Prioritize what matters most: Safety items are non-negotiable, but designer clothes aren't

- •Not everything needs to be perfect day one: You can add items as you go

- •Your baby won't remember the nursery decor: Focus on function over aesthetics

- •Build your village: Friends and family can help with hand-me-downs and childcare

Every family's situation is unique, and there's no one-size-fits-all budget for a baby. The key is to be realistic about your specific needs, values, and resources. Whether you use a sophisticated baby budget app or a simple spreadsheet, consistent tracking and regular adjustment will help you navigate the financial aspects of parenthood with confidence.

And remember—while the financial side of parenting matters, it's just one part of the journey. Many of the best things about being a parent don't cost a thing.